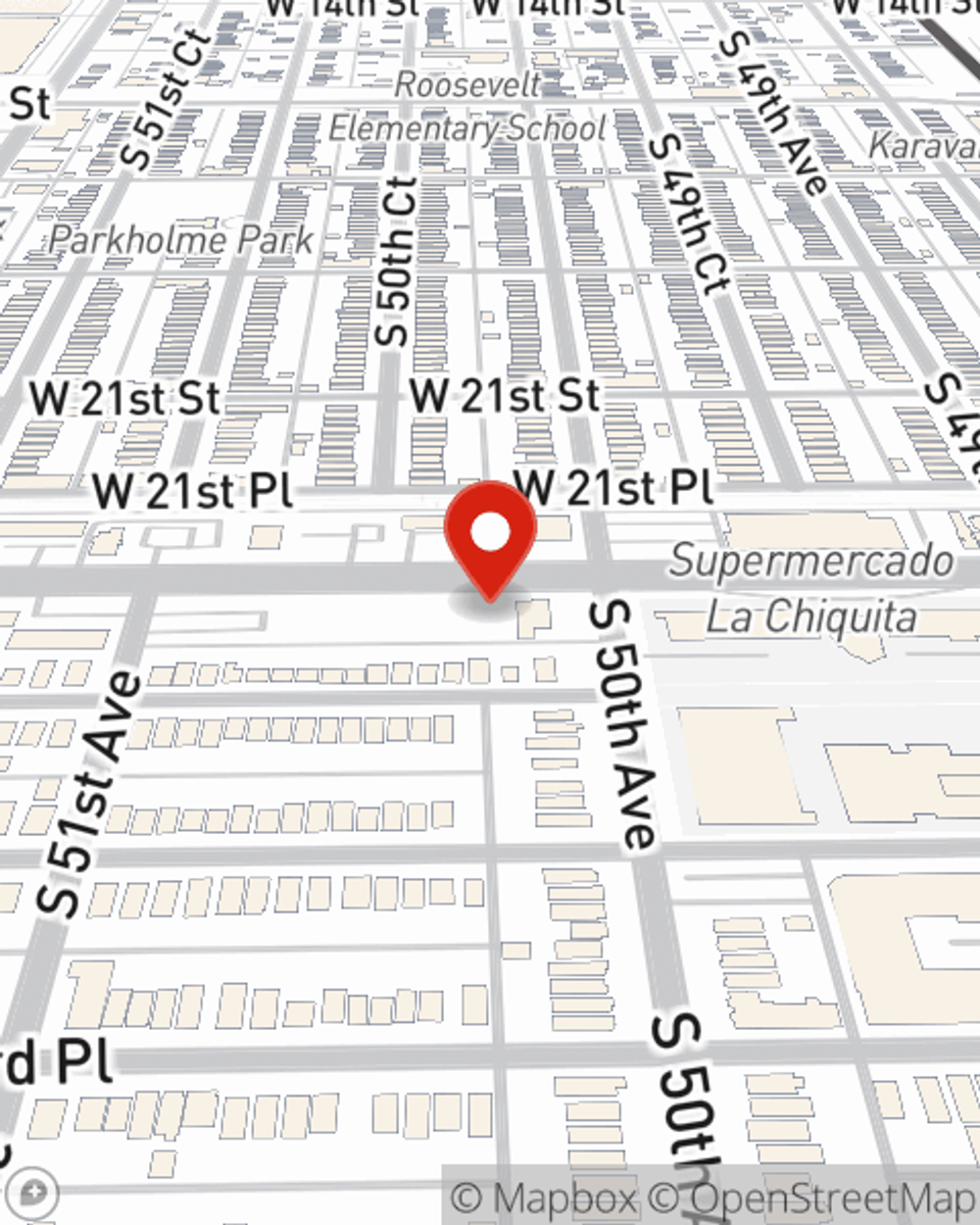

Homeowners Insurance in and around Cicero

Protect what's important from the unexpected.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

- Cicero

- BERWYN

- LITTLE VILLAGE

- LAWNDALE

Insure Your Home With State Farm's Homeowners Insurance

Being at home is great, but being at home with coverage from State Farm is the cherry on top. This excellent coverage is more than just precautionary in case of damage from ice storm or hailstorm. It also has the ability to protect you in certain legal situations, such as someone getting hurt in your home and holding you responsible. If you have the right coverage, these costs may be covered.

Protect what's important from the unexpected.

Give your home an extra layer of protection with State Farm home insurance.

State Farm Can Cover Your Home, Too

Protection for your home from State Farm is a great next step. Just ask your neighbors. And contact agent Armando Guzman for additional assistance with finding a policy that fits your needs.

There's nothing better than a clean house and protection with State Farm that is reliable and value-driven. Make sure your valuables are protected by contacting Armando Guzman today!

Have More Questions About Homeowners Insurance?

Call Armando at (708) 656-5100 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Things to consider when replacing a roof

Things to consider when replacing a roof

When your house needs a roof replacement, you might wonder what material and warranty options there are. Learn about some questions to ask a roofing contractor.

Insurance terms simplified: the basics

Insurance terms simplified: the basics

Knowing your insurance basics can help you on your path to understanding your policy and coverage. Here’s some terms you’ll want to know.

Armando Guzman

State Farm® Insurance AgentSimple Insights®

Things to consider when replacing a roof

Things to consider when replacing a roof

When your house needs a roof replacement, you might wonder what material and warranty options there are. Learn about some questions to ask a roofing contractor.

Insurance terms simplified: the basics

Insurance terms simplified: the basics

Knowing your insurance basics can help you on your path to understanding your policy and coverage. Here’s some terms you’ll want to know.